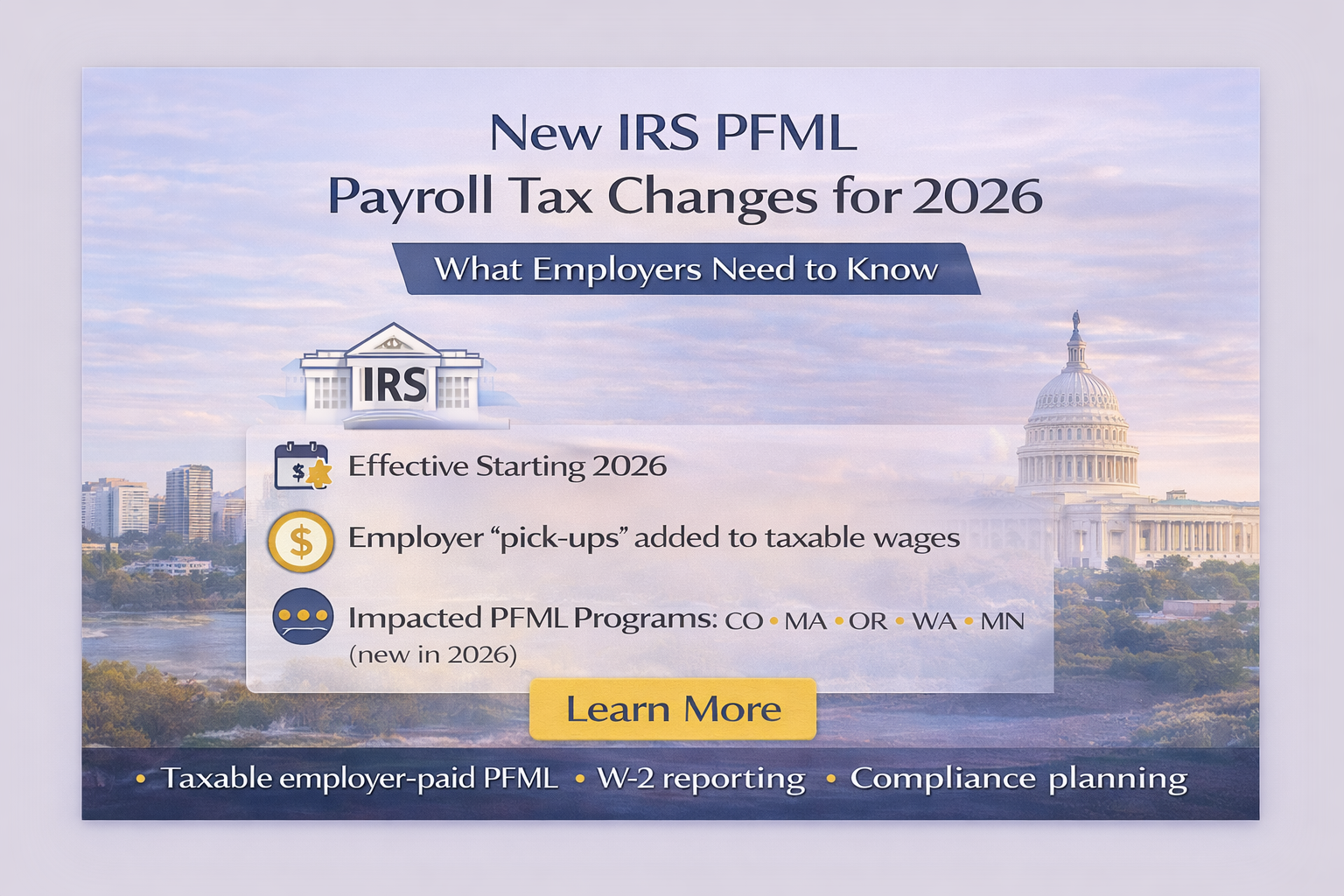

New IRS Rules for Employer-Paid PFML Contributions Take Effect in 2026

Starting in 2026, new IRS rules require employer-paid PFML contributions to be treated as taxable wages. Employers must ensure payroll systems are properly configured to remain compliant.