SPRING

A Practical Checklist for Government Contractors

SAM.gov registration is not a single form—it is a multi-step validation process that requires accurate entity information, supporting documentation, and internal consistency across legal, tax, and operational records.

Most registration delays and rejections occur because documentation does not align with how the entity is entered in the system. Entity registration is a gatekeeping requirement for federal contracts and financial assistance. Inaccurate or incomplete submissions can result in:

Delayed activation

Failed validation

Ineligibility to bid or receive funds

These issues are rarely technical. They are usually documentation and decision-preparation issues.

How Organizations Reduce Registration Risk

Organizations that avoid registration delays treat SAM.gov preparation as a decision-stage process, not a clerical task.

Applying structured review before submission reduces failed validations, audit exposure, and lost contracting opportunities. This approach aligns with the Human Capital Risk Prevention Framework™, where governance is introduced before execution—not after rejection.

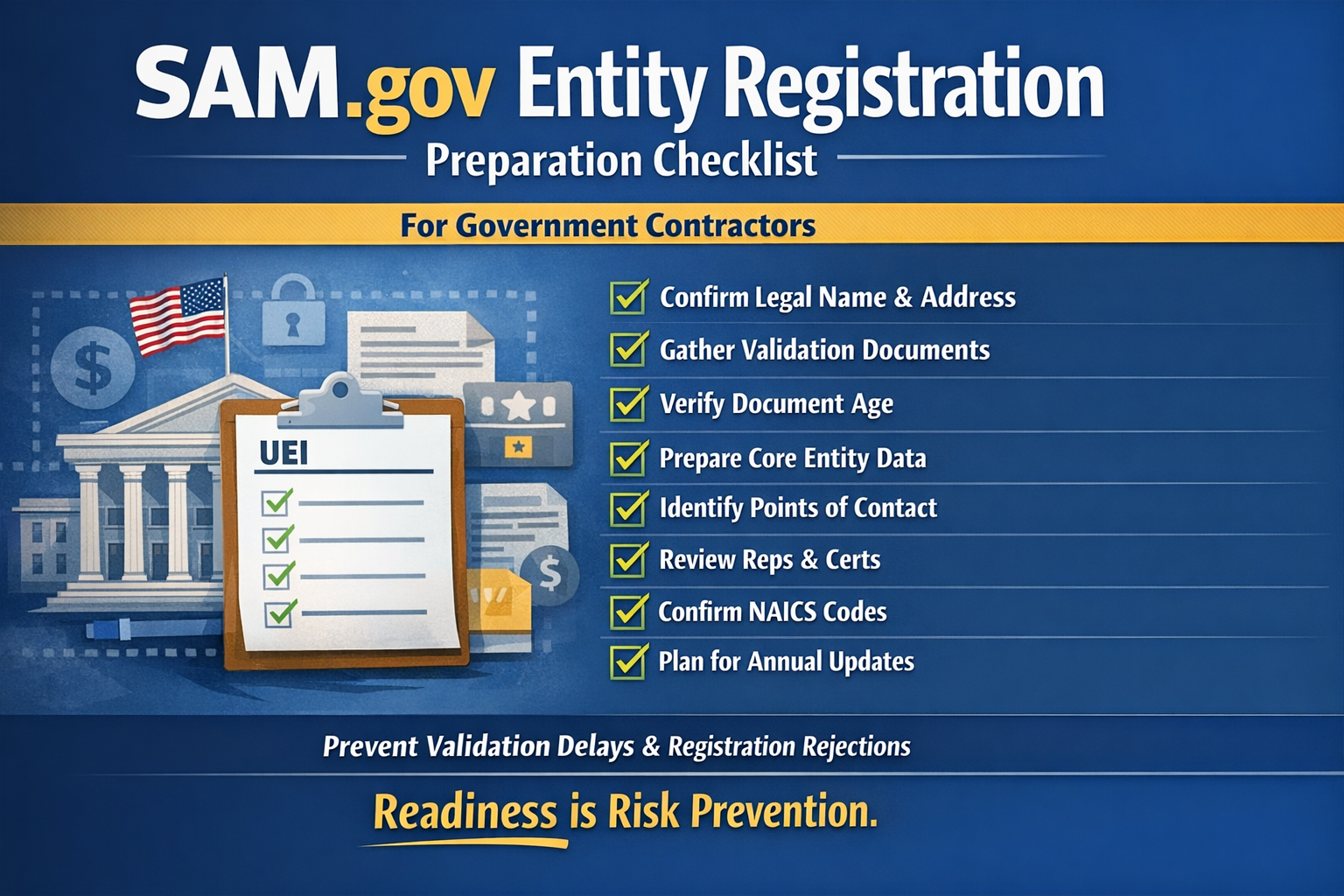

SAM.gov Entity Registration — Preparation Checklist

Step 1: Confirm How Your Entity Is Entered

Before gathering documents, confirm:

Legal business name (exact spelling, punctuation, suffixes)

Physical business address (no P.O. boxes)

Entity structure (LLC, corporation, sole proprietorship, etc.)

State and year of formation

All documentation must match these entries exactly EVS Documentation Requirements.

Step 2: Gather Entity Validation Documents (EVS)

You must submit documentation that proves:

Name and address

Start year and state of incorporation

National identifier (international entities only)

Acceptable Documentation (Most Common)

Articles of Incorporation / Organization (stamped)

Secretary of State Certificate of Filing

IRS EIN assignment letter

Current business registry screenshot (with URL)

Utility bill (water, gas, or electric only)

At least one document must show both the full legal name and physical address EVS Documentation Requirements.

Step 3: Verify Document Age and Validity

Documents marked with an asterisk (*) must be no more than five years old

All information must be current and accurate

Redact unnecessary sensitive data (bank balances, SSNs, etc.)

Outdated documents are a frequent cause of validation failure EVS Documentation Requirements.

Step 4: Prepare Core Entity Data

Before entering SAM.gov, confirm:

Date of incorporation

Fiscal year-end

Taxpayer Identification Number (TIN)

Banking information for EFT payments

CAGE or NCAGE code (or readiness to request one)

This information must be internally consistent across legal, tax, and banking records Entity Registration Checklist.

Step 5: Identify Required Points of Contact (POCs)

At minimum, prepare contact information for:

Accounts Receivable POC

Electronic Business POC

Government Business POC

These roles are used for validation, notifications, and audit communication—not just administration Entity Registration Checklist.

Step 6: Review Representations & Certifications (Reps & Certs)

Be prepared to answer questions related to:

Prior terminations for cause

Criminal, civil, or administrative proceedings

Delinquent federal taxes

Debarment or suspension history

Equal employment and affirmative action compliance

These responses are legal attestations, not administrative checkboxes Entity Registration Checklist.

Step 7: Confirm NAICS Codes and Size Metrics

Prepare:

Primary and secondary NAICS codes

Employee count

Annual receipts

Incorrect size or classification data can affect eligibility and future audits Entity Registration Checklist.

Step 8: Plan for Ongoing Maintenance

SAM.gov registrations must be renewed every 365 days

Changes to ownership, address, banking, or leadership must be updated

Validation failures can suspend eligibility without warning

Registration is not “set it and forget it” Entity Registration Checklist.

Common Mistakes This Checklist Helps Prevent

Submitting documents that don’t match system entries

Using outdated or expired documentation

Treating Reps & Certs as administrative rather than legal

Fragmenting responsibility across HR, finance, and operations

Waiting until a bid deadline to address validation issues