New IRS Rules for Employer-Paid PFML Contributions Take Effect in 2026

Employer-Paid PFML Contributions Are Now Taxable Wages — Here’s What That Means

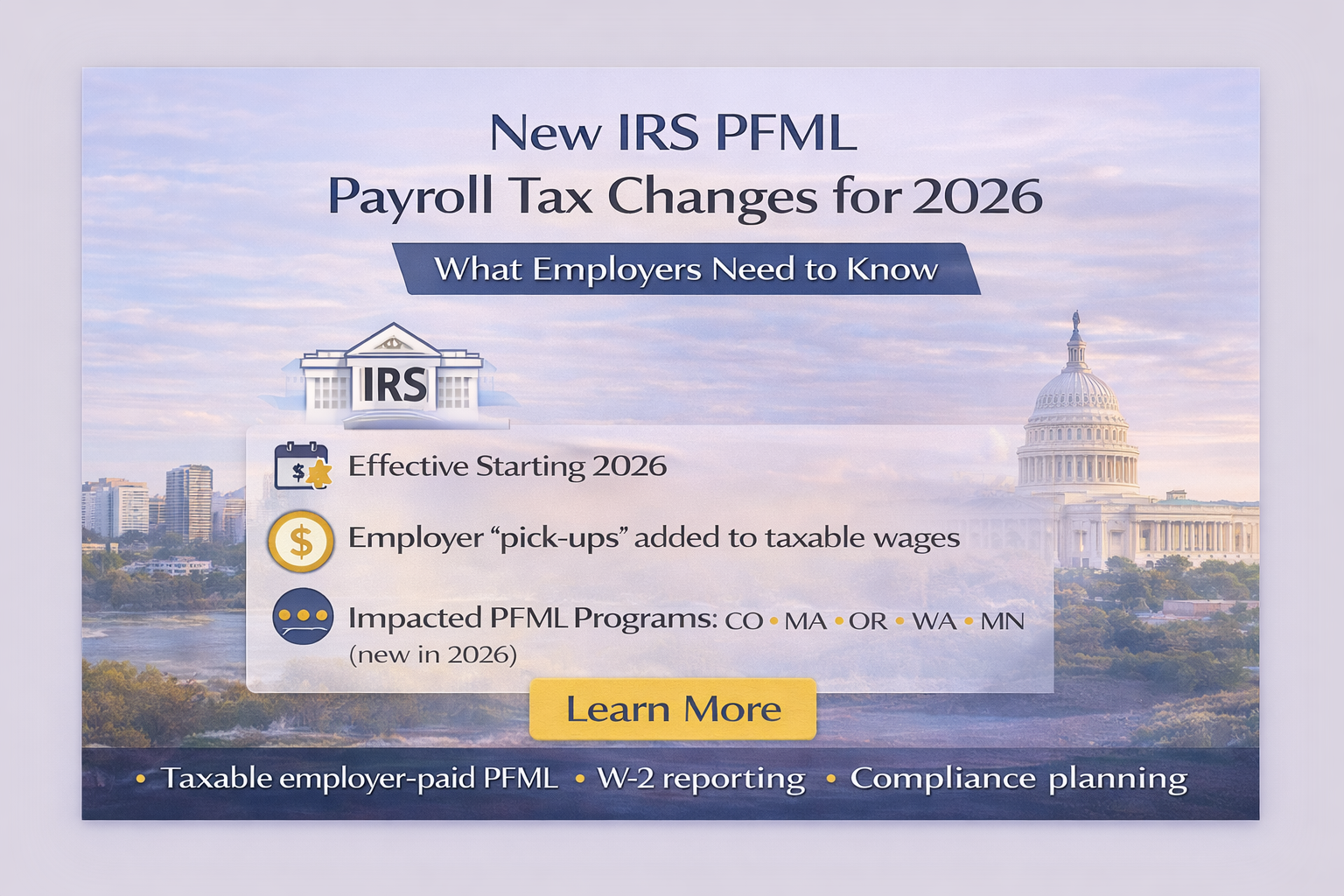

Starting with the 2026 tax year, new IRS guidance changes how employer-paid Paid Family and Medical Leave (PFML) contributions must be treated for federal tax purposes.

Under IRS Revenue Ruling 2025-4, when an employer voluntarily pays an employee’s share of PFML taxes, those amounts must now be included in the employee’s federal taxable wages.

This rule applies regardless of whether the employee receives additional take-home pay.

What Changed Under IRS Revenue Ruling 2025-4

Beginning in 2026:

Employer-paid employee PFML contributions are taxable income

These amounts must be included in Box 1 of the employee’s W-2

Taxes must be calculated accordingly, even though no extra cash is paid to the employee

This creates a distinction between taxable vs. payable compensation, which must be handled precisely within payroll systems.

New IRS payroll tax rules effective in 2026 requiring employer-paid PFML contributions to be included as taxable wages, highlighting compliance and reporting considerations for employers.

States Impacted by This IRS Change

The employer contribution “pick-up” rule applies to PFML programs in:

Colorado

Massachusetts

Oregon

Washington

Minnesota (new in 2026)

PFML programs not impacted by this IRS change include:

Connecticut

Delaware

District of Columbia

Maine

New Jersey

New York

For multi-state employers, this distinction is critical.

Why This Matters Operationally

Without proper payroll configuration, organizations risk:

Under-reporting taxable wages

Incorrect W-2 reporting

Payroll tax discrepancies

Employee confusion over pay statements

Increased audit exposure

This is not simply a tax update—it is a payroll architecture issue.

Building Compliance Into Payroll Systems

Rather than relying on workarounds, consulting support ensures that payroll software is configured to:

Properly classify employer-paid PFML contributions

Apply correct tax treatment automatically

Reflect contributions clearly on pay statements

Maintain compliance across multiple PFML jurisdictions

When built correctly, payroll runs remain seamless—even as tax rules grow more complex.

A Broader Human Capital Perspective

These IRS changes highlight a larger trend: payroll and tax compliance are no longer siloed administrative tasks. They sit at the intersection of human capital strategy, financial governance, and risk management.

Organizations that treat compliance as a system—rather than a series of fixes—are far better positioned to scale without disruption.

Disclaimer: This content is informational only and does not constitute legal or tax advice. Employers should consult legal and tax professionals regarding compliance.