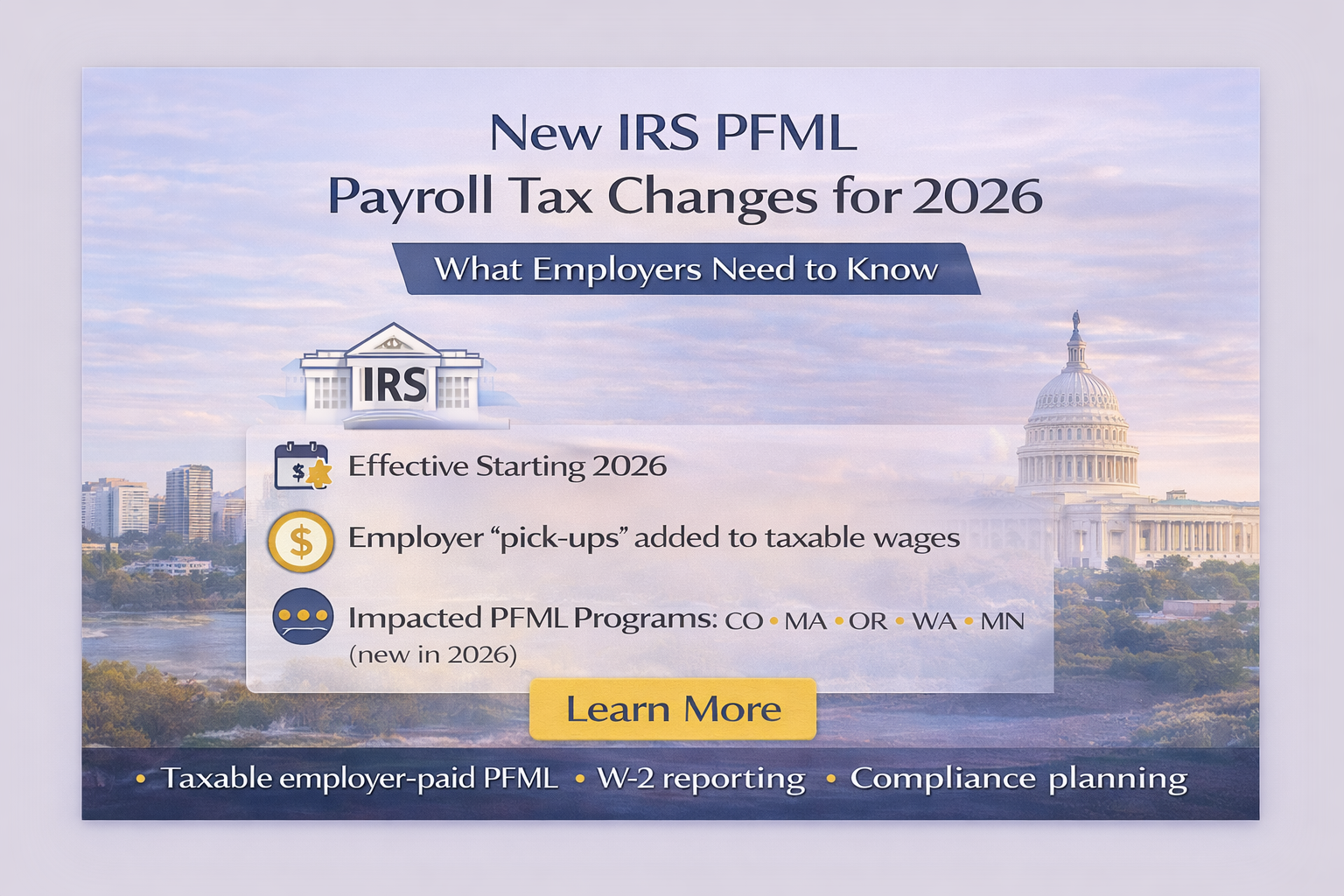

New IRS Rules for Employer-Paid PFML Contributions Take Effect in 2026

Starting in 2026, new IRS rules require employer-paid PFML contributions to be treated as taxable wages. Employers must ensure payroll systems are properly configured to remain compliant.

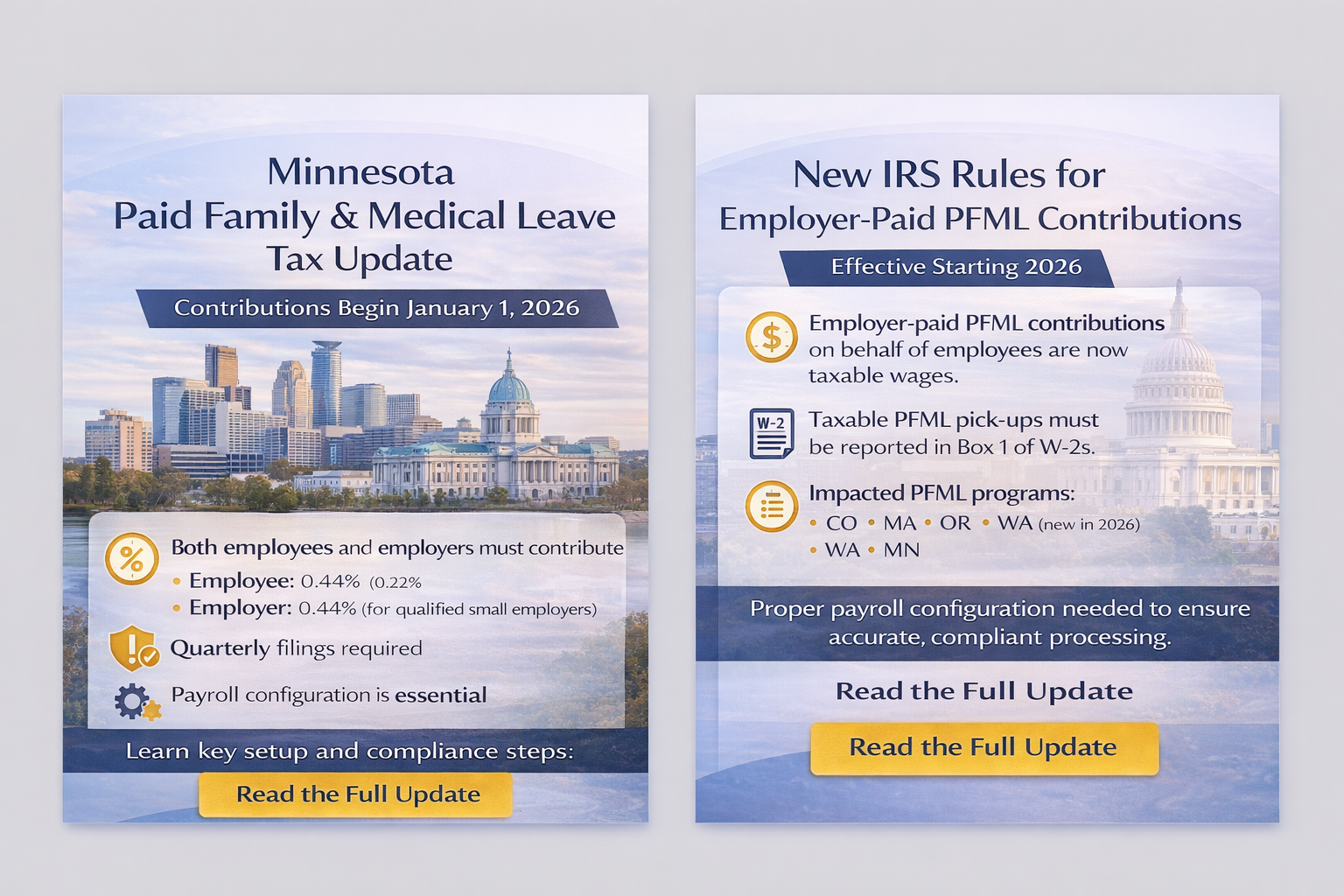

Minnesota PFML Contributions Begin January 1, 2026 — What Employers Need to Prepare Now

Beginning January 1, 2026, Minnesota employers and employees will be required to contribute to the state’s new Paid Family and Medical Leave (PFML) program. While the policy goal is straightforward, the payroll and compliance execution is not—especially for organizations operating across multiple states or with mixed workforce classifications.

Philadelphia Ban the Box Updates Effective January 2026

Philadelphia’s “Ban the Box” Law Is Changing Again—Here’s What Employers Need to Know Before January 2026.