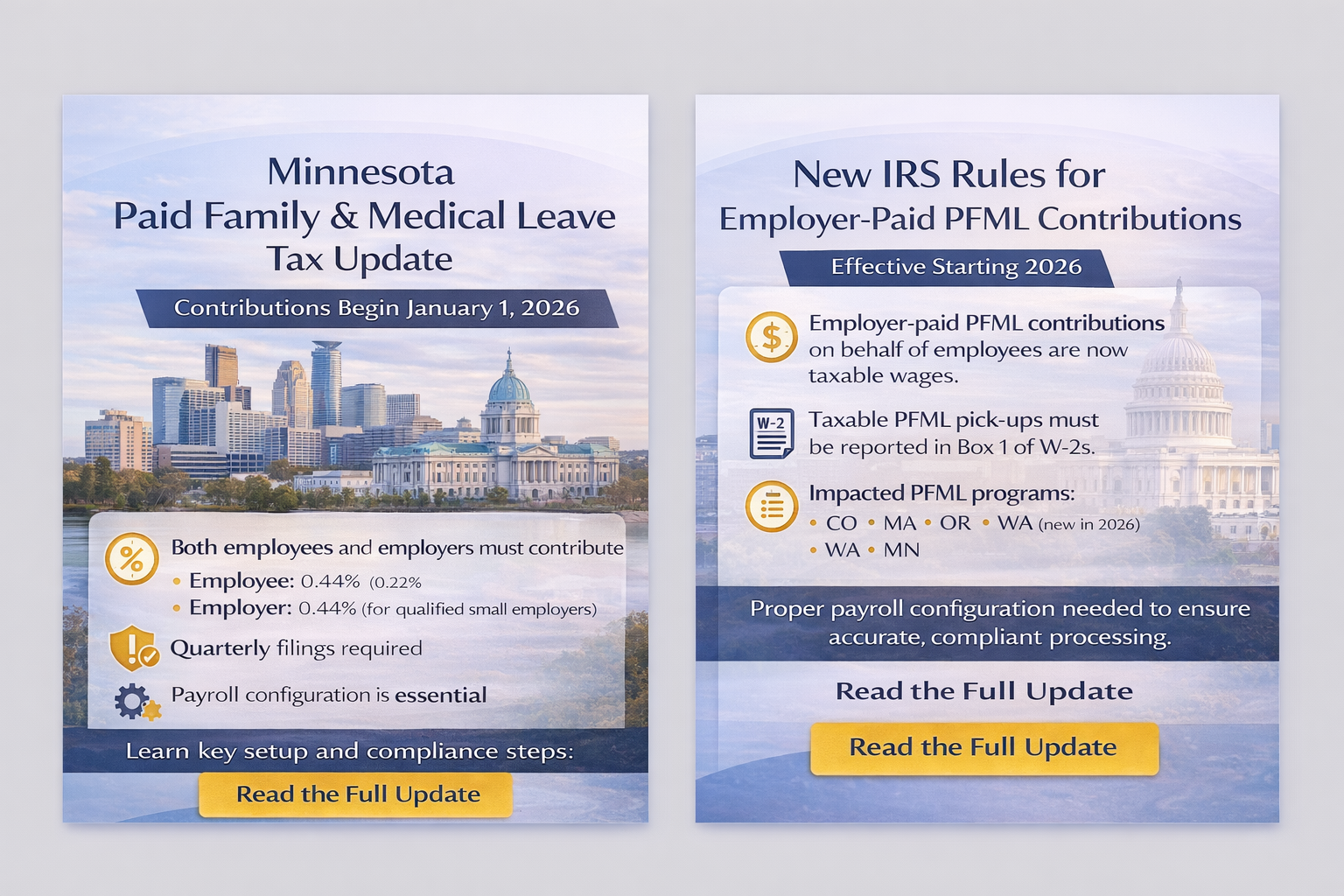

Minnesota PFML Contributions Begin January 1, 2026 — What Employers Need to Prepare Now

Beginning January 1, 2026, Minnesota employers and employees will be required to contribute to the state’s new Paid Family and Medical Leave (PFML) program. While the policy goal is straightforward, the payroll and compliance execution is not—especially for organizations operating across multiple states or with mixed workforce classifications.

From a human capital and payroll systems perspective, this change requires intentional setup, testing, and ongoing monitoring to ensure accuracy and compliance.

What Minnesota Employers Need to Know

Under Minnesota’s PFML program:

Both employers and employees contribute to the tax

Standard 2026 contribution rates are:

Employee: 0.44% of PFML-taxable wages

Employer: 0.44% (or 0.22% for qualified small employers)

Employers may elect to cover some or all of the employee portion

PFML taxes must be filed and paid quarterly

These contributions apply to Minnesota PFML-taxable wages, which must be accurately tracked by work location—not just employee residence.

Employer-Paid Contributions Require Special Handling

If an employer chooses to cover any portion of the employee’s PFML contribution, those amounts must be handled carefully within payroll:

Employer-covered employee contributions remain taxable income

These amounts must be included in federal taxable wages

Contributions must be reflected accurately on employee pay statements

Employees’ net pay cannot fall below Minnesota minimum wage as a result of PFML deductions

This creates a direct intersection between payroll configuration, tax compliance, and wage-and-hour obligations.

Why Payroll System Configuration Is Critical

Minnesota PFML is not something that can be “fixed later.” Payroll systems must be configured to:

Apply correct employer and employee rates

Identify covered wages correctly

Track employer-paid employee portions separately

Ensure taxable treatment is applied properly

Prevent minimum wage violations

Consulting support helps organizations build these protections directly into payroll software, ensuring PFML is processed accurately, consistently, and defensibly—without relying on manual adjustments or last-minute corrections.

Preparing for January 2026

Smart preparation includes:

Reviewing payroll system capabilities and configuration

Confirming contribution elections and small-employer status

Testing minimum wage impact scenarios

Training internal teams on how PFML appears on pay statements

Establishing quarterly filing and reconciliation procedures

Minnesota PFML is manageable—but only when treated as a systems and process change, not a simple tax add-on.

Disclaimer: This content is informational only and does not constitute legal or tax advice. Employers should consult legal and tax professionals regarding compliance.