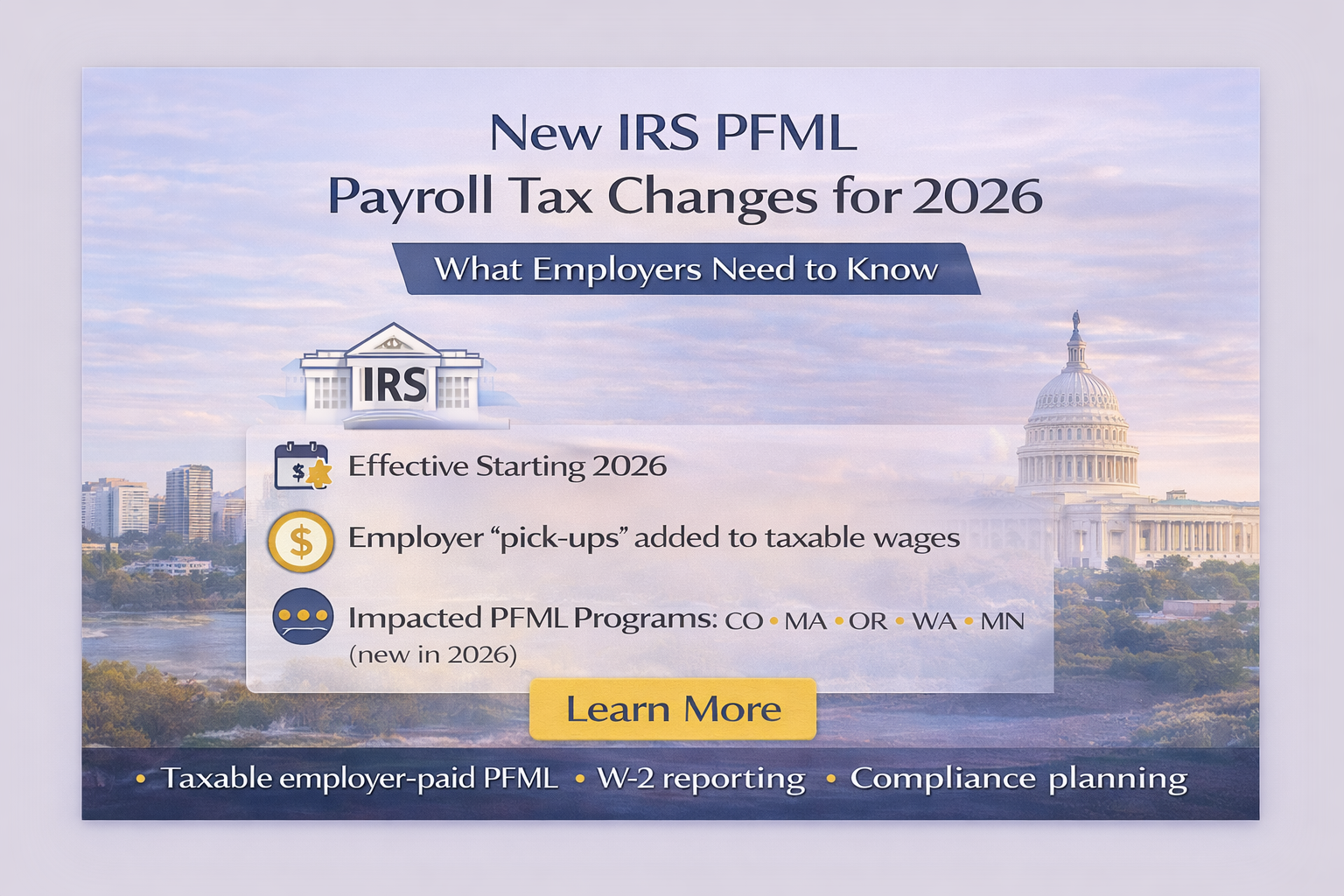

New IRS Rules for Employer-Paid PFML Contributions Take Effect in 2026

Starting in 2026, new IRS rules require employer-paid PFML contributions to be treated as taxable wages. Employers must ensure payroll systems are properly configured to remain compliant.

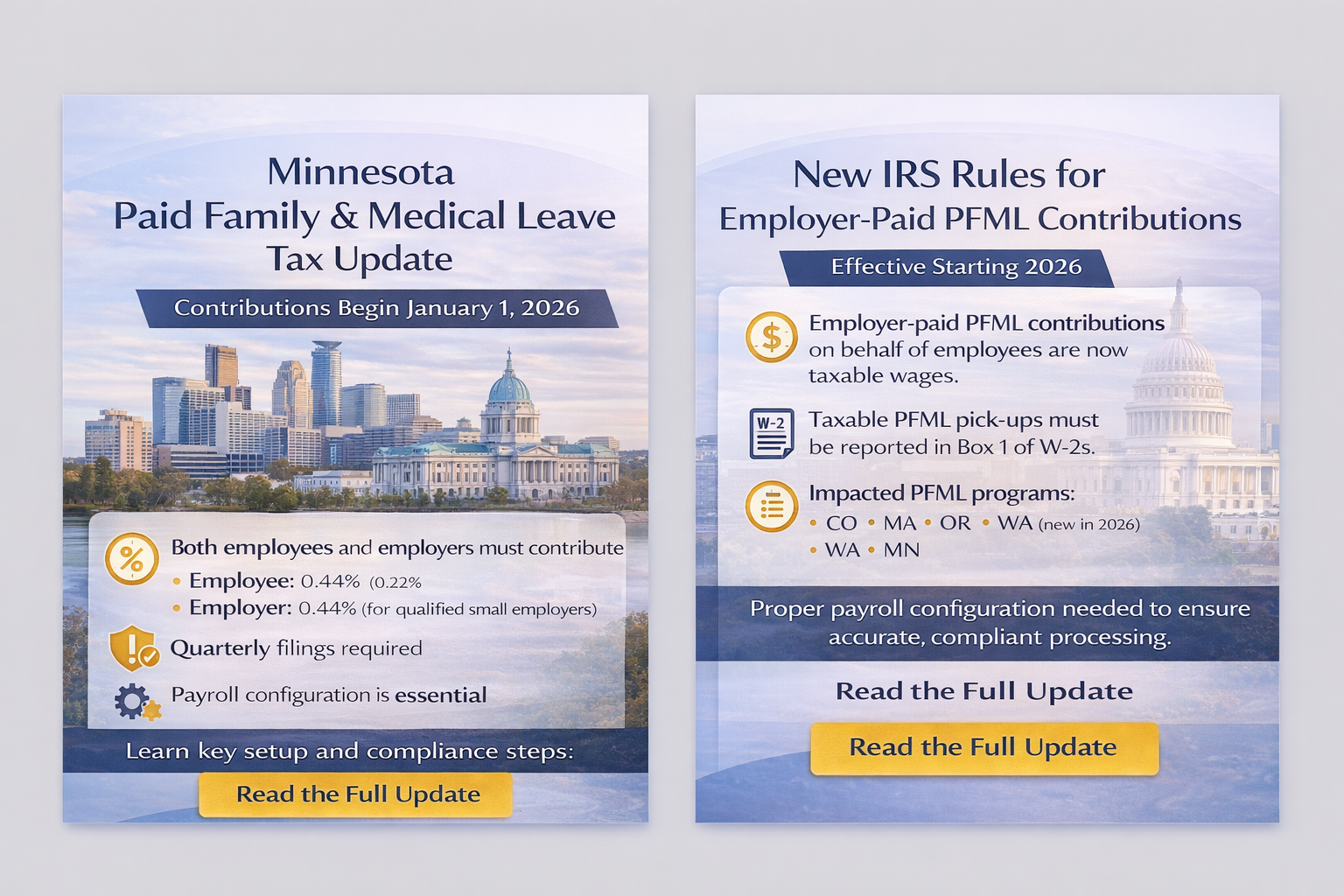

Minnesota PFML Contributions Begin January 1, 2026 — What Employers Need to Prepare Now

Beginning January 1, 2026, Minnesota employers and employees will be required to contribute to the state’s new Paid Family and Medical Leave (PFML) program. While the policy goal is straightforward, the payroll and compliance execution is not—especially for organizations operating across multiple states or with mixed workforce classifications.

Influence Without Control: The Mediation Skill That Resolves Conflict Faster

Why Experience Matters in Mediation

Not all mediation is equal.

True mediation expertise lies in understanding human behavior under pressure—how insecurity shows up as defensiveness, how power dynamics distort communication, and how poorly framed conversations can derail resolution entirely.

At KSC, mediation is approached as a structured, strategic process designed to restore clarity, preserve relationships where possible, and resolve disputes efficiently—without unnecessary escalation or litigation exposure.

Because resolution isn’t about winning.

It’s about moving forward with certainty.

Philadelphia Ban the Box Updates Effective January 2026

Philadelphia’s “Ban the Box” Law Is Changing Again—Here’s What Employers Need to Know Before January 2026.

Why Human Capital Strategy Is Where Revenue Is Won or Lost

Clarity Is the Advantage

If January already feels heavy, that’s not a failure.

It’s a signal.

It means the business has reached a point where clarity matters more than hustle, and structure matters more than effort.

I don’t help organizations guess.

I help them design systems that last.

That’s where execution stabilizes.

That’s where leadership gets lighter.

And that’s where revenue finally has room to grow.